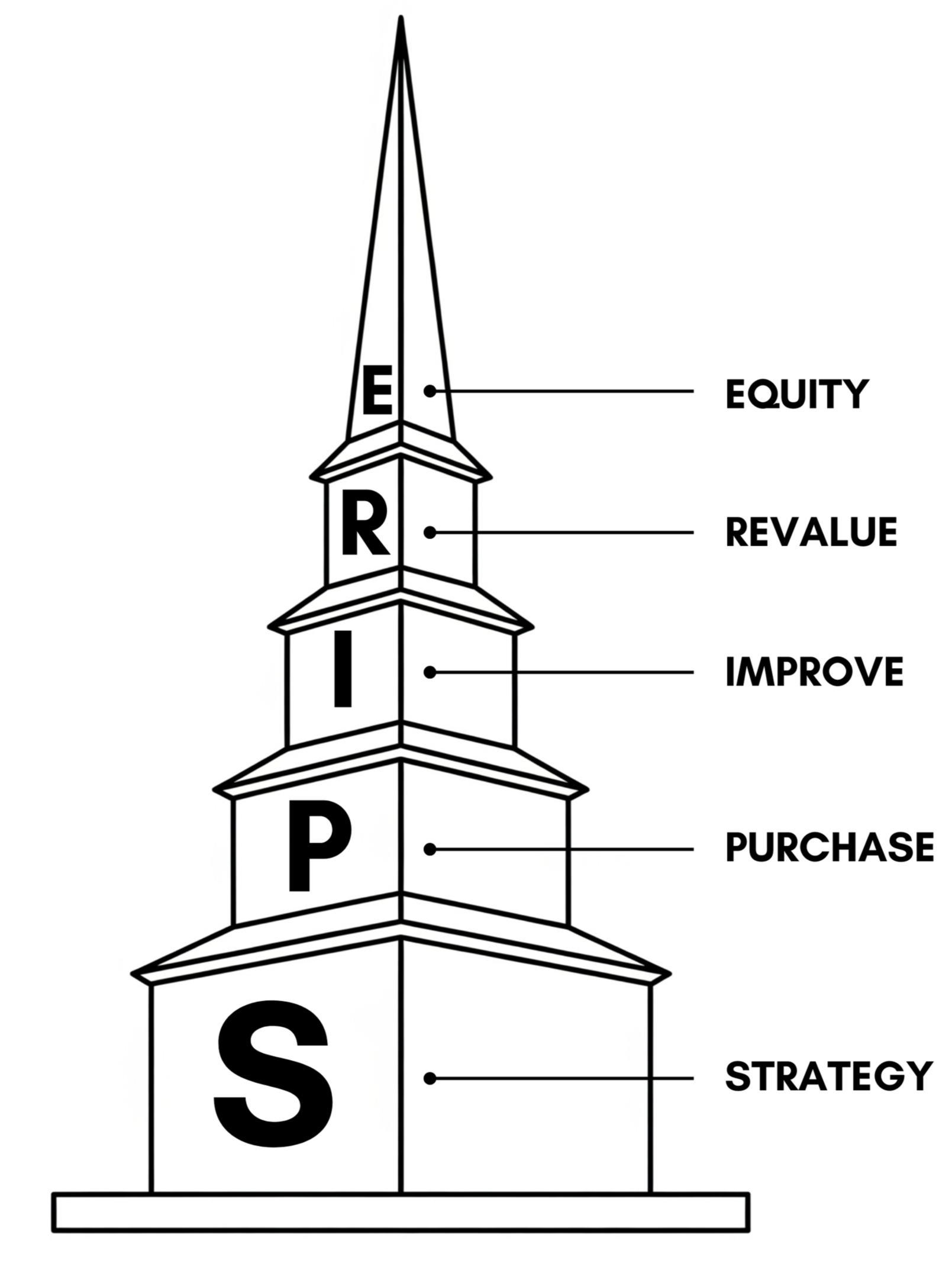

The SPIRE Method™: Accelerating Your Property Portfolio

Building a successful property portfolio requires a strategic approach that goes beyond simply buying and holding. The SPIRE Method™ is a proven framework designed to manufacture capital growth, helping investors in Adelaide and beyond accelerate their results and grow their wealth faster than traditional saving.

Here’s a breakdown of the five core elements of the SPIRE Method™:

S — Strategy

Before a single property is considered, we establish a comprehensive strategy. This involves defining your brief, understanding your financial goals, and ensuring you have the optimal finance and ownership structures in place to support long-term growth.

P — Purchase

We identify and secure the right type of property in a high-growth location and at the right price. This is the foundation of your investment, ensuring your asset has the potential to outperform the market from day one.

I — Improvements

This is where we manufacture capital growth. By adding tangible value through strategic improvements—such as renovations, layout optimisations, sub-divisions, or adding a granny flat—we increase the property's value and rental yield beyond what the market alone provides.

R — Revaluation

Once improvements are complete, we facilitate a correct revaluation of the property. This step is crucial for formally recognising the new, higher value of your asset, which has been enhanced by the strategic improvements and increased rental income.

E — Equity

The final step in the cycle is to unlock the newly created equity. By leveraging the revalued property, you can access the released funds to use as a deposit for your next investment purchase. This process allows you to bypass years of saving, enabling you to grow your portfolio faster and more efficiently.

The SPIRE Method™ is a cyclical strategy, designed to be rinsed and repeated. It creates a powerful flywheel effect where one successful investment fuels the next, supercharging your property portfolio growth.

The SPIRE Method has been formulated from over 10 years of experience as way to boost results and maximise your investment property

How the SPIRE Method Works in Practice

Let's illustrate the power of this strategy with a simple example:

Initial Purchase: Property bought for $700,000 (with a 20% deposit)

Strategic Improvements: $70,000 spent on value-adding renovations

Post-Improvement Value: The property is revalued at $840,000

This represents a $140,000 increase in value from an initial investment of just $70,000—a $2 return for every $1 spent on the renovation.

The accessible equity is calculated as: New Value x Loan to Value Ratio (LVR) (e.g. 80%) - Existing Loan Balance

Using this example, the accessible equity is: ($840,000 x 80%) - $560,000 = $112,000

This demonstrates how strategic improvements can unlock significant capital, allowing you to access $112,000 in released funds to use as a deposit for your next investment property. This approach allows you to expand your portfolio far more quickly than if you were to rely on saving alone.

Be aware though, you need to complete the right due diligence, be confident in your feasibility, undertake cost effective improvements and structure the purchase right.

Real Life Case Study

Want to see if you qualify for the Spire Method? Click below to learn more.