Who We Are

At Leverage Property Buyers, we do more than just find you an investment property — we help you take action faster, smarter, and with confidence.

Too often, we hear from people who have been “thinking about buying” for 6 months, 12 months, even 2 years… and they’re still looking. Meanwhile, Adelaide’s market has been climbing 10%+ per year. Waiting costs you money — decisive action builds wealth. That’s where we come in.

What Sets Us Apart

We buy what others won’t. Many buyers’ agents avoid “too hard” properties. We actively seek them out — especially those with strong renovation or value-add potential. These are the properties that can transform your portfolio.

Construction expertise you can trust. With over 20 years of hands-on construction experience and 20+ successful flip and renovation projects under our belt, we see opportunities others miss.

A trusted team behind you. From settlement support to a vetted network of reliable trades, you’ll have the right people in place to add value post-purchase.

Data-driven decisions. We remove emotion from the process and rely on analysis, numbers, and proven frameworks to ensure every purchase is a smart one.

Market access beyond realestate.com.au. Thanks to our agent relationships, we secure not just on-market deals, but also pre-market and off-market opportunities.

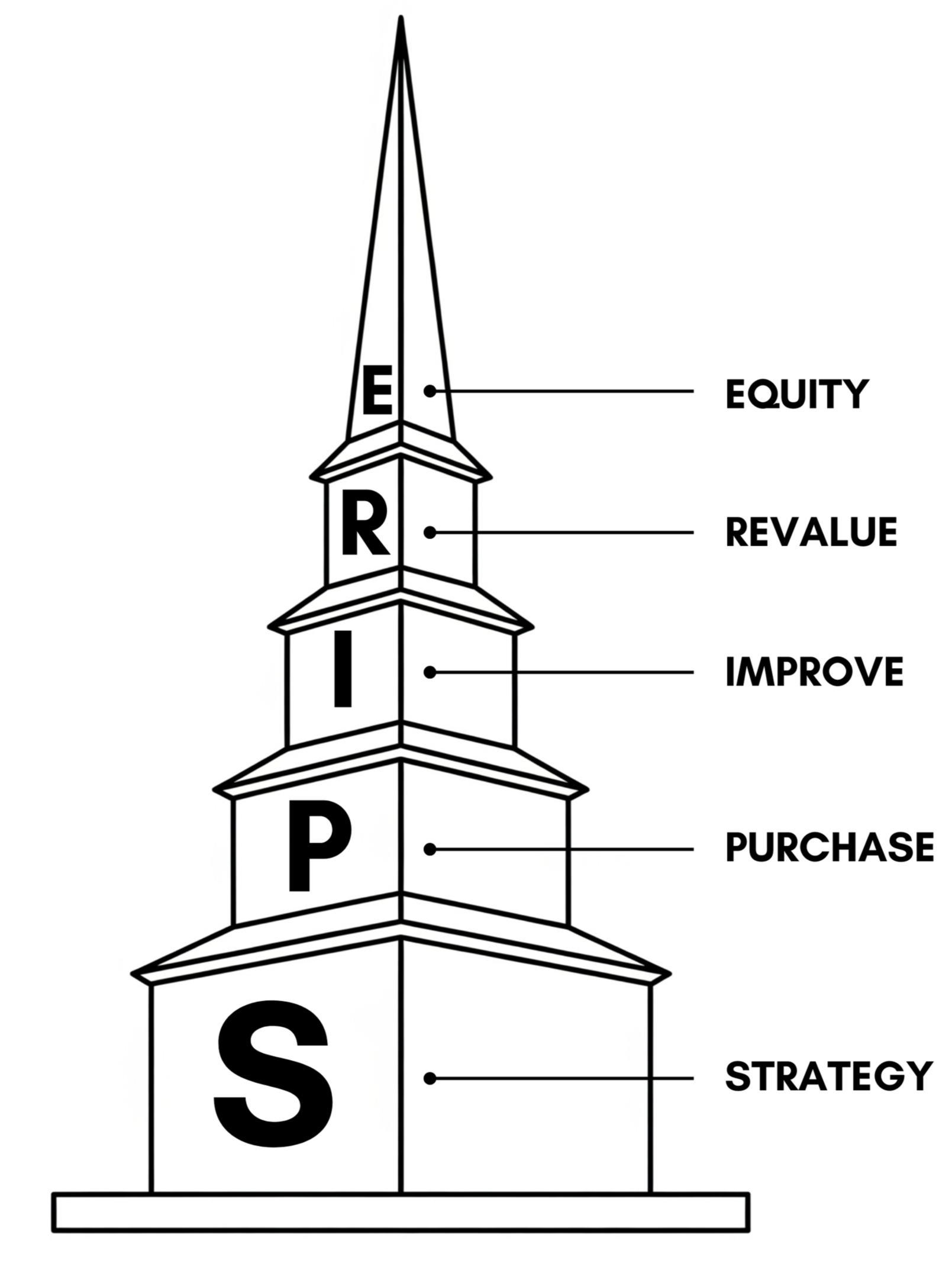

Our Advantage: The SPIRE Method

We’ve developed our own unique system — the SPIRE Method — designed to identify and unlock properties with untapped potential. It’s a framework that blends strategy, construction knowledge, and market analysis to create faster results for our clients.

The SPIRE Method has been formulated from over 10 years of experience as way to boost results and maximise your investment property

How the SPIRE Method Works in Practice

Let's illustrate the power of this strategy with a simple example:

Initial Purchase: Property bought for $700,000 (with a 20% deposit)

Strategic Improvements: $70,000 spent on value-adding renovations

Post-Improvement Value: The property is revalued at $840,000

This represents a $140,000 increase in value from an initial investment of just $70,000—a $2 return for every $1 spent on the renovation.

The accessible equity is calculated as: New Value x Loan to Value Ratio (LVR) (e.g. 80%) - Existing Loan Balance

Using this example, the accessible equity is: ($840,000 x 80%) - $560,000 = $112,000

This demonstrates how strategic improvements can unlock significant capital, allowing you to access $112,000 in released funds to use as a deposit for your next investment property. This approach allows you to expand your portfolio far more quickly than if you were to rely on saving alone.

Be aware though, you need to complete the right due diligence, be confident in your feasibility, undertake cost effective improvements and structure the purchase right.

Want to see if you qualify for the Spire Method? Click below to learn more.